Why invest in Tampa?

Tampa is growing

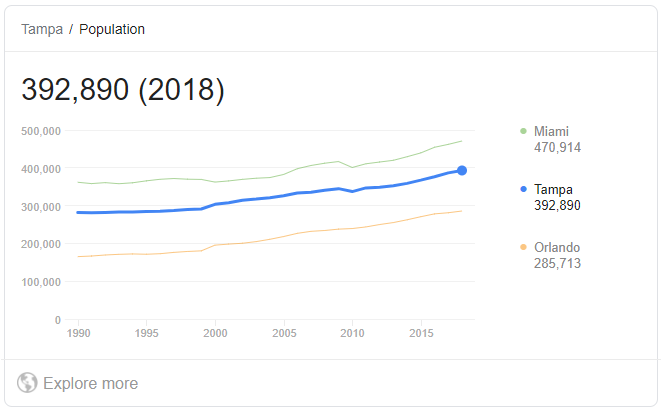

With a population of 399,700 in 2019, Tampa is the third-largest city in Florida, after Miami and Jacksonville. The bay's port is the largest in the state, near downtown's Channel District. Bayshore Boulevard runs along the bay, and is east of the historic Hyde Park neighborhood. The city had a population of 335,709 at the 2010 census, and an estimated population of 392,890 in 2018. As of 2018, Tampa's annual growth rate is 1.63%.

Rising wages and job count

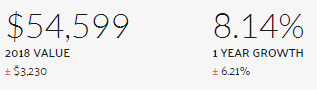

Households in Tampa, FL have a median annual income of $54,599, which is less than the median annual income of $61,937 across the entire United States. This is in comparison to a median income of $50,489 in 2017, which represents a 8.14% annual growth.

The following chart shows how the median household income in Tampa, FL compares to that of its neighboring and parent geographies.

Source

Real Estate Values

The Tampa housing market continues to show signs of life, with affordability serving as the main facilitator. Accordingly, Tampa continues to remain one of the nation’s most affordable markets. Even though Tampa is currently above historical affordability levels, homeowners allocate less than 8 percent of their income to monthly mortgage payments. That is less than half of the national average. As such, Tampa could attract many first-time buyers. Millennials, in particular, should find Tampa to be an attractive destination because of affordability alone.

Affordability is likely the reason behind international interest in the Tampa housing market. Having said that; Tampa has become a primary target for foreign investors. Nearly 11 percent of Tampa’s home sales were foreign in nature. In fact, Tampa has surpassed Miami in terms of sales to non-U.S. residents. Looking to escape the cold, Canadians make of the largest pool of foreign investors taking stakes in Tampa.

Source

Tons of Stuff to do

Ybor City

Lively Ybor City is known for boutiques and vintage shops on 7th Avenue, which also hosts Cuban and Latin American eateries. The Centro Ybor mall offers indie fast food, bars, and a cinema. Housed in a 1920s bakery, Ybor City State Museum has exhibits on the cigar industry and the area’s immigrant communities. The GaYBOR district around 7th Avenue and 15th Street attracts a diverse crowd to its bars and clubs.

Howard Ave, Tampa FL

Howard ave in Tampa FL is the epicenter for night life in Tampa. With a close walking distance to numerous hot clubs and bars, Howard ave is the place to be and be seen. MacDinton's Irish pub, and many other bars have created an absolute party atmosphere of attractive people. There are also many places to eat and shop in the area. In general the neighborhoods are upscale and were built in the early 1900's giving all of the real estate a quaint uniqueness that can only be explained by actually visiting.

To much to list!

Tampa Acquarium, Boating, Fishing, Straz Center - concerts, Live Music, Bayshore Beautiful, Picnic Island Park / beach. Restaurants, Concerts, Curtis hixon park, Rich history, The River Walk. Professional sports teams, The Amelie Arena, Tampa Bay Lightning (hockey), Tampa Bay buccaneers (Football). Yankees Spring training. We could keep going! So much to explore!

Affordable living

With lower-than-average rents and utilities, Tampa Bay is one of the most affordable areas of its size in the nation. At least, according to new data released this week.

A recent report from the Council for Community and Economic Research found that Tampa Bay now has the lowest cost of living out of all of Florida’s urban areas. It’s also the cheapest region out of more than a dozen similarly sized metro areas around the nation analyzed by the nonprofit Tampa-Hillsborough Economic Development Corp.

The report calculated Tampa Bay’s Cost of Living Index score based on six categories: housing, utilities, groceries, transportation, health care and miscellaneous goods and services. Prices for goods and services from each of these services are added up to create the index. The baseline, 100, is the average of all of the prices from the participating areas.

Source

On the way up

Tampa has experienced such an incredible amount of growth and development in the past 10 years. It is has been a blessing to really watch this city grow. Contact us if you are interested in moving or investing in Tampa FL in the surrounding area. We would love to help you.

Investment opportunities / Syndication

What we do

We provides opportunities for investors to become passive equity partners in institutional-quality, recession-resistant, real estate. Our direct access allows investors to invest alongside experienced operating partners who have a proven track record of delivering attractive risk-adjusted returns.

Our goal is to help investors build long-term wealth and passive income streams through a diversified offering of value-add multifamily, investments located in growing markets in Hillsborough County Florida.

The deals we fund provide opportunities for investors to preserve capital investments, generate tax-efficient income, and build equity through future capital appreciation of the assets.

Our Process

Real estate syndication is an effective way for accredited investors to pool their financial resources to acquire properties and projects much bigger than they could afford or manage on their own. Our syndicated equity comes from a multitude of sources including 1031 exchanges in the form of Tenant-In-Common ownership, IRA investments, and from accredited investors who are seeking to place as little as $25,000 in a sponsored investment.

We act as the Sponsor in the pooling of investor equity to acquire value-add multifamily properties in carefully selected neighorhoods in Florida. HRE contributes a portion of the equity and its decades of experience in the sourcing, acquiring and asset managing of the properties within the Company'’'s portfolio on behalf of its investors.

We provide investors with a secure, online portal updated with their monthly reports, distributions, market data and annual assessments and also work to identify, evaluate and tap new investment opportunities. We continuously monitor regional markets and property performance and advise owners on optimal strategies for refinancing, holding and/or selling.